Overall Summary

| Feature | IG |

| Overall | 5 Stars |

| Trust Score | 99 |

| Offering of Investments | 5 Stars |

| Commissions & Fees | 4.5 Stars |

| Platforms & Tools | 5 Stars |

| Research | 5 Stars |

| Mobile Trading Apps | 5 Stars |

| Education | 5 Stars |

Is IG safe?

IG is considered low-risk, with an overall Trust Score of 99 out of 99. IG is publicly traded, does operate a regulated bank, and is authorised by seven tier-1 regulators (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). IG is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC), Japanese Financial Services Authority (JFSA), Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Financial Conduct Authority (FCA), Financial Markets Authority (FMA) – New Zealand, and the Commodity Futures Trading Commission (CFTC). Learn more about Trust Score.

Regulations Comparison

| Feature | IG |

|---|---|

| Year Founded | 1974 |

| Publicly Traded (Listed) | Yes |

| Bank | Yes |

| Tier-1 Licenses | 7 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 1 |

| Trust Score | 99 |

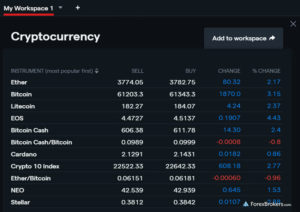

Offering of investments

The range of markets available to you may vary depending on which of IG’s regulatory entities holds your account. Residents of the U.K., New Zealand, Japan, and the U.S. must choose their respective local IG entity.

Alongside nearly 20,000 CFDs, IG offers exchange-traded securities (non-CFDs) for residents of the U.K. (see our IG U.K. share dealing review), Germany, and Australia to access international stock exchanges. In addition to forex options, IG offers exchange-traded Turbo warrants as part of Spectrum, its Multilateral Trading Facility (MTF) in Europe, and listed derivatives in the U.S. via tastytrade. IG Bank in Switzerland is also an option for eligible clients.

Cryptocurrency: Cryptocurrency trading is available at IG through CFDs, but not available through trading the underlying asset (e.g., buying Bitcoin). IG does not offer crypto derivatives in the U.K. to retail traders.

The following table summarizes the different investment products available to IG clients.

IG offering of investments:

| Feature | IG |

|---|---|

| Forex Trading | Yes |

| CFD Trading | Yes |

| Tradeable Symbols (Total) | 19537 |

| Forex Pairs (Total) | 100 |

| US Stock Trading (Non CFD) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy-Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Crypto Disclaimer (UK) | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

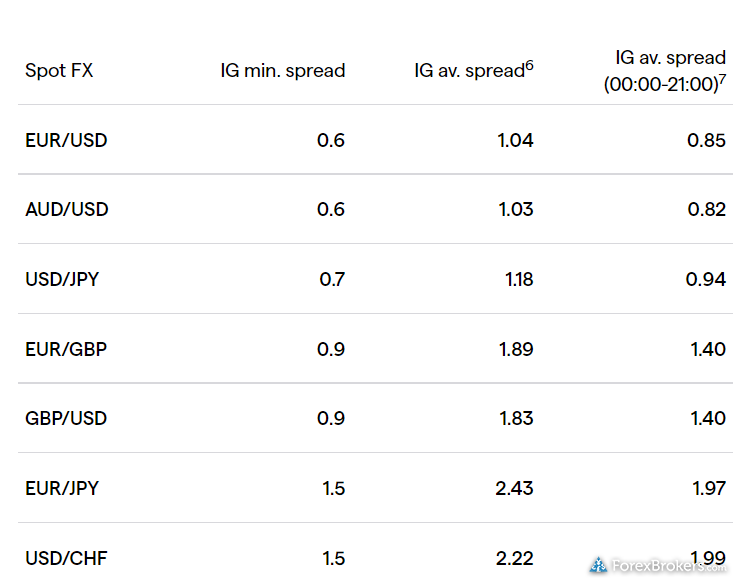

IG’s size allows it to provide scalable execution across the board – regardless of the product being traded. While IG can’t be considered a discount broker, it shines for the active trader pricing available through its Forex Direct accounts, and its ability to execute large orders. Spreads on its main account offering are closer to the industry average in 2021, with spreads averaging 0.828 the majority of the time (23 hours a day) during September 2021.

CFD account average spreads: For both mini and standard-size contracts, typical spreads during the main trading session (22 hours each day from 0000 – 2200 GMT) averaged 0.768 pips for the month of September 2021 – which is slightly better than the industry average. It is worth noting that – just like with most Master Fx Review – IG’s spreads during low-liquid times can be higher than normal, averaging 0.994 pips when including the remaining hours in the trading day (2100 to 0000 GMT) during the same timeframe as the above September 2021 data.

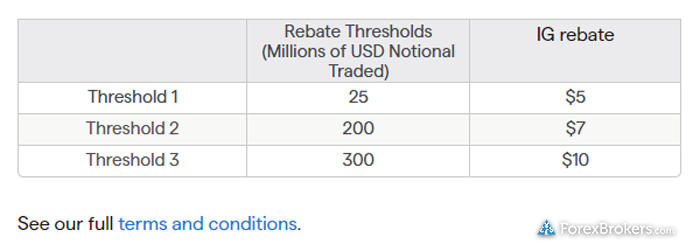

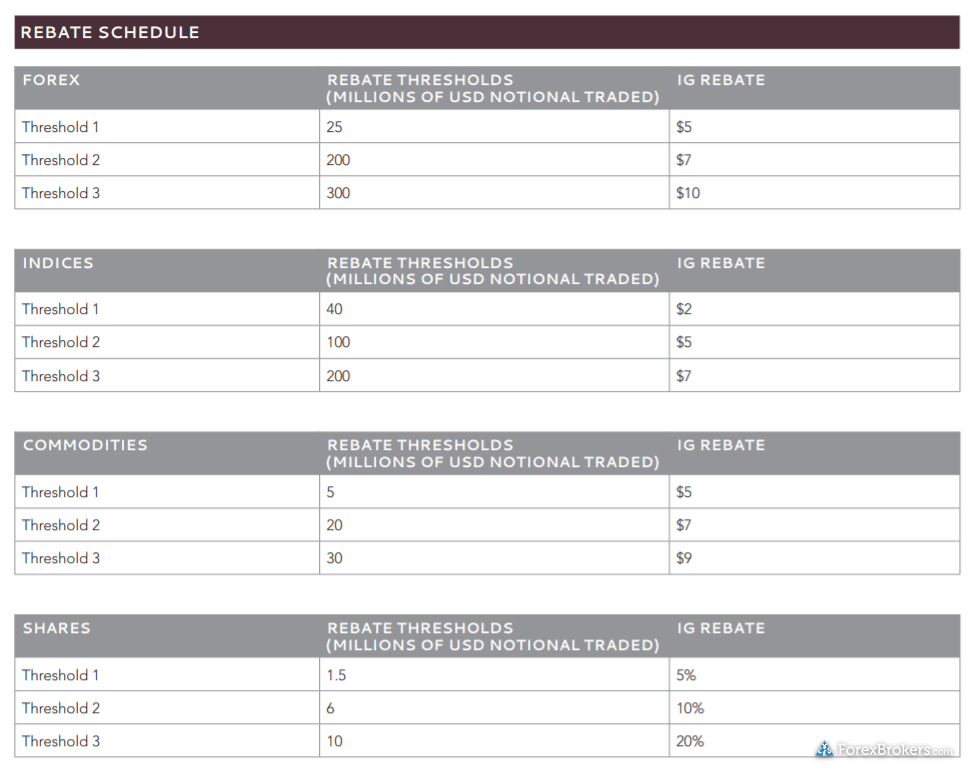

CFD account active trader rebates: For volume traders who qualify as professionals under EU rules, IG offers pricing discounts via its three-tier active-trader rebate program. In tier one, you can earn a 10% spread rebate if you transact over £50 million worth of forex volume per month. Meanwhile, if you trade over £300 million per month, the rebate jumps to as much as 20%. To put this into a different context, 20% off of 0.76 pips is 0.17 pips, which would result in an all-in cost of just 0.60 pips – a very competitive spread.

DMA account (Forex Direct): For the savviest traders seeking more significant discounts than what is offered in the CFD account, the DMA account is an even better option than the active trader rebates on IG’s spread-only pricing. This commission-based offering, Forex Direct, is available via the DMA account and provides traders access to the L2 Dealer platform. The DMA account requires just a £1,000 minimum and uses a tiered pricing scale based on the trader’s previous month’s trading volume.

DMA account average spreads: With average spreads of 0.165 on the EUR/USD for the 12 weeks ending March 19th, 2019, the all-in spread is 1.3 pips using the base tier of $60 per million for traders that do less than $100 million per month. Traders that do over 1.5 yards (one yard = $1 billion in volume) see their per-side commission drop to $10 per million ($20 round-turn), resulting in an effective spread of 0.365 pips – using the 2019 data.

IG pricing summary:

| Feature | IG |

|---|---|

| Minimum Deposit | £250.00 |

| Average Spread EUR/USD – Standard | 0.828 (September 2021) |

| All-in Cost EUR/USD – Active | 0.365 (May 2020) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

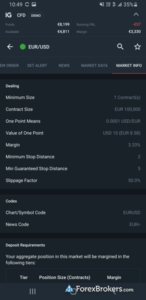

Mobile trading apps

IG’s mobile app competes with the best in the industry, and comes packed with plenty of features that will satisfy both casual and advanced traders. The charts in IG’s app are arguably my favorite from among all brokers, due to the extensive range of available features.

Apps overview: IG offers two trading apps: the popular MetaTrader 4 (MT4) app, alongside its own flagship mobile app, IG Trading (also known as IG Forex). There is also the IG Academy app for education, and IG Access for account security – but neither supports trading. The IG Trading app has a well-designed layout that’s teeming with features such as alerts, sentiment readings, and highly advanced charts. Research consists of news headlines from Reuters, signals from Autochartist, and PIA First.

Ease of use: IG’s mobile app does a decent job of balancing ease-of-use with the depth of its available features. Navigating integrated news headlines from Reuters, or switching to market analysis and trading signals is a breeze on IG’s app.

The only drawback is the lack of predefined watchlists or screeners, which makes it more difficult to sift through IG’s massive product list. Charts, however, are superb on mobile, and sync seamlessly with the web platform. For example, a chart template saved on the web can be applied to charts on the mobile appThere are syncing watchlists, though it’s worth noting that trend lines do not sync, like they do on SaxoTraderGO from Saxo Bank. Still, there is a lot to like about the IG mobile app.

Charting: IG’s mobile app is loaded with 30 technical indicators, 20 drawing tools, and 16 selectable time frames across five distinct chart types – including tick charts. Setting up charts is easy, and zooming in and out across time frames feels quick and precise. Chart indicators added on the web platform won’t automatically sync with the mobile app (although they can be saved as presets). Still, it was an absolute pleasure to use IG Mobile’s charts.

IG mobile trading:

| Feature | IG |

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Alerts – Basic Fields | Yes |

| Watch List | Yes |

| Watch List Syncing | Yes |

| Charting – Indicators / Studies | 32 |

| Charting – Draw Trendlines | Yes |

| Charting – Trendlines Moveable | Yes |

| Charting – Multiple Time Frames | Yes |

| Charting – Drawings Autosave | Yes |

| Forex Calendar | Yes |

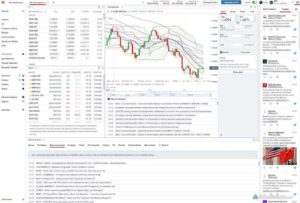

Other trading platforms

IG provides an outstanding selection of trading platforms and tools, with functionality that serves traders of all experience levels.

Platforms overview: While IG does offer the popular MetaTrader 4 platform, alongside the L2 Dealer DMA platform and ProRealTime charting software platform, I focused my testing on IG’s flagship web platform. Usability is at the heart of the experience for IG’s proprietary web-based platform, which comes loaded with a vast selection of features. For example, charts open from nearly any view, and display live market prices and streaming bid/ask rates. There is a seemingly endless variety of research and trading tools, including integrated risk-management modules. One minor caveat is that you must take a few minutes to set up the layout, as the default view is mostly empty – though you can save multiple custom layouts.

Charting: Default charts within the IG platform feature advanced functionalities, such as the ability to add up to four alerts to any of its 11 supported indicators. Besides five chart types, there is also a tick chart – a useful feature that isn’t offered by every broker. I also appreciated that zooming in and out and resizing the view across time frames all felt very fast and smooth. Lastly, trading from the chart with an integrated trade ticket shows risk/reward ratios, and allows you to drag stops/limits with great precision.

Specialty platforms: IG offers the MetaTrader4 (MT4) platform and its L2 Dealer platform, where Forex Direct and Direct Market Access (DMA) are available for share trading. While I do not recommend MT4 due to its limited available product range, L2 Dealer – which requires a minimum deposit of $1,000 – can be a viable option due to the discounts available for active traders, and for its support of advanced algorithmic order types.

ProRealTime charts: ProRealTime – a third-party platform exclusively offered by IG in the U.K. – offers advanced charting with nearly 100 indicators and support for automated strategies. ProRealTime costs £30 per month unless you make at least four trades during each calendar period. While the ProRealTime layout is highly customizable, my testing left me thinking it could use a modern upgrade. For example, floating windows can get messy and are inferior to modern snap grid layouts. That said, its charts were an absolute pleasure to use, and I appreciated the automatic coloring of studies, which made them easier to view when adding multiple indicators.

IG trading platform:

| Feature | IG |

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy-Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| cTrader | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 32 |

| Charting – Drawing Tools (Total) | 20 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 14 |

| Order Type – Market | Yes |

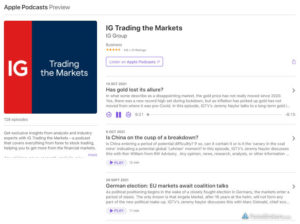

Market research

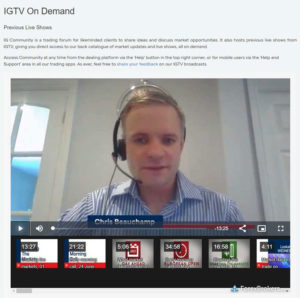

IG provides a vast selection of excellent quality market research from both in-house and third-party providers. The sheer amount of content in IG’s platform – including in-house broadcasting with IGTV – is only matched by TD Ameritrade (U.S. residents only), and Interactive Brokers.

Research overview: IG’s research tools include streaming news and TV from Reuters, trading signals, in-house broadcasting via IGTV, and an economic calendar and weekly forecast (The Week Ahead series) in video and article format, alongside multiple daily blog updates with market analysis.

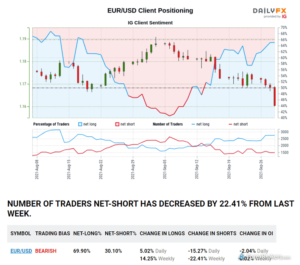

Advanced tools include a customizable screener for various asset classes, including CFDs on global stocks, forex. IG’s innovative “Recommended News” section personalizes your content, aiming to tailor headlines based on your account traits. The additional DailyFX content practically doubles the already impressive amount of research provided by IG.

Market news and analysis: IG integrates Autochartist and PIA First into its platform, allowing traders to view trade signals generated by automated pattern recognition and technical analysis. These trading ideas can be conveniently copied with a single click, which pre-populates the trade ticket window. IG also provides multiple daily articles and videos that are posted throughout the trading week.

DailyFX and IG Community: IG powers DailyFX, a blog-style news website that provides IG clients with news content and various research tools. IG Community, a recently launched social network resembling an advanced forum, brings together over 60,000 users. While the content is crowdsourced, I still found it to be valuable as IG hand-picks the best research articles. There is also a timeline (akin to a social network) that shows member actions such as new joins, follows, and comments on threads.

IG research:

| Feature | IG |

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Delkos Research | No |

| Social Sentiment – Currency Pairs | Yes |

| Economic Calendar | Yes |

Education

IG is a leader for its educational content, offering a vast selection of material in a variety of formats, including video, written articles, numerous weekly webinars, and guides from DailyFX. There are educational courses organized by experience level on IG Academy, complete with progress tracking and quizzes. IG also provides a dedicated mobile app for education, and its strong social community of over 64,000 members provides a selection of crowd-sourced articles.

Learning center: Educational content is scattered across its website, its YouTube channel, and its DailyFX offering. DailyFX offers eight trading guides for beginners, five advanced guides, and written materials in a well-designed course that features progress tracking. In addition to educational content, there are seven articles about risk-management from Bollinger Bands, 17 beginner articles, and support is also available for additional languages.

IG Academy: IG Academy features eight courses that are organized by experience level, each containing nearly a dozen chapters. These courses are an interactive experience, with video content, lesson summaries, and quizzes incorporated throughout the coursework. There is also a final quiz where you receive a total score reflecting how many questions were answered correctly.

Videos: In addition to a wealth of archived content and various playlists on its YouTube channels, IG offers its own in-house broadcasting with IGTV. Featuring content such as multiple weekly webinars, weekly podcasts, IGTV is an excellent educational tool. IG staff also cover educational topics in a live format, such is the Technical Analysis Masterclass. Even archived webinars are organized by experience level, making it easy to find what you need quickly.

IG Community: As noted in the research section above, the IG Community produces content that is curated by IG. Some of this content takes the form of educational articles, while some of it has more of a narrative structure, with traders sharing their personal views, as well as their past trading successes and failures.

Room for improvement: As a leader in this category, IG has little room to enhance its already well-rounded educational offering. Consolidating content from the IG Academy mobile app into the main IG Trading app could be one way to bring all of its educational material into one place, which would make for a more streamlined, accessible experience. It also wouldn’t hurt to include more advanced material, in both written and video format.

IG education:

| Feature | IG |

|---|---|

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Retail forex and CFD traders who want a trusted broker with brilliant tools, research, and access to nearly every global market (over 19,500 tradeable assets) will find that IG is a fantastic choice.

IG finished Best in Class across multiple categories in 2022, including Offering of Investments, Commissions and Fees, Platform and Tools, Research, Education, Mobile Trading, Professional Trading, Trust Score, and Overall.

Bottom line, IG is my top pick for 2022.

Is IG a good broker?

Yes, IG is an excellent broker that ranks at the top in nearly all key categories of importance to traders.

As an online broker, IG goes above and beyond to offer a rich experience with many options for investing in financial markets. Its trading costs, platforms, ease of use, education, mobile apps, research, range of markets, and trading tools make it a winner.

Is my money safe with IG?

Yes, IG holds more regulatory licenses than any other online broker that offers forex and CFDs. Its decades of operation, reputation, and requirements as a publicly traded company mean IG is considered a safe broker to hold client assets, including cash money.

IG holds your funds across a variety of banks and collectively services over 191,000 active clients as of its latest trading update in early 2021. It is important to use a broker that is well-capitalized to reduce your potential counterparty risk, and IG’s market capitalization of over 3.19 billion pounds (as of May 12, 2021), makes it a safe choice.

What is the minimum deposit for IG trading?

The minimum deposit with IG varies from $250 or 300 euros (EUR), to as much as 2,500 Swiss francs (CHF), depending on which IG entity you choose to establish a trading account with as well as your country of origin.

For example, clients of IG South Africa must deposit at least 4,000 South African rand (ZAR), whereas at IG Japan the minimum is 35,000 Japanese yen (JPY). With IG Australia the smallest deposit for a live account is 450 Australian dollars (AUD); in Singapore, it’s 400 Singapore dollars (SGD).

About IG

As an early pioneer in offering contracts for difference (CFDs) and spread betting, IG was founded in 1974 and has grown to be a global leader in the online trading industry. IG is a London-based public company listed on the London Stock Exchange’s FTSE 250 (LON: IGG) with a market capitalization of £3.539B as of October 2021.

As of its annual report for the financial year ending May 31, 2021, IG has 2,034 staff, servicing nearly 313,300 active clients globally across its regulated entities in the UK and internationally.