Overall summary

| Feature | Interactive Brokers |

| Overall | 5 Stars |

| Trust Score | 99 |

| Offering of Investments | 5 Stars |

| Commissions & Fees | 5 Stars |

| Platforms & Tools | 4.5 Stars |

| Research | 4.5 Stars |

| Mobile Trading Apps | 4.5 Stars |

| Education | 4 Stars |

Is Interactive Brokers safe?

Interactive Brokers is considered low-risk, with an overall Trust Score of 99 out of 99. Interactive Brokers is publicly traded, does not operate a bank, and is authorised by eight tier-1 regulators (high trust), one tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Interactive Brokers is authorised by the following tier-1 regulators: Interactive Brokers is authorised by the following tier-1 regulators: Investment Industry Regulatory Organization of Canada (IIROC), Securities Futures Commission (SFC), Japanese Financial Services Authority (JFSA), Financial Conduct Authority (FCA), Monetary Authority of Singapore (MAS), Central Bank of Ireland (CBI) – Ireland, and the Commodity Futures Trading Commission (CFTC).

Regulations Comparison

| Feature | Interactive Brokers |

| Year Founded | 1977 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 8 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Trust Score | 99 |

Offering of investments

Interactive Brokers offers a significant range of tradeable global markets. However, the availability of those markets will depend on where you reside and which Interactive Brokers entity holds your account. For example, retail spot forex trading is not available to U.S. residents (unless you are designated as an ‘Eligible Contract Participant’ by Interactive Brokers), and CFDs are not available to clients in the U.S., Canada, or Hong Kong.

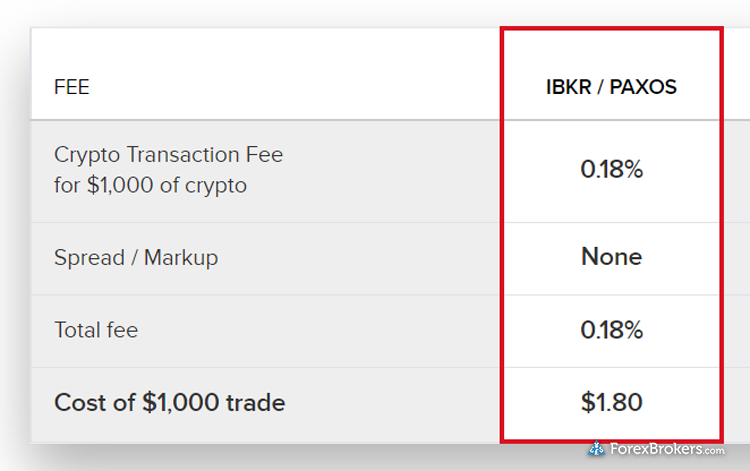

Cryptocurrency: Cryptocurrency trading is not available at Interactive Brokers through CFDs, but is available through trading the underlying asset (e.g. buying Bitcoin) through Interactive Brokers partnership with Paxos. Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents.

The following table summarizes the different investment products available to Interactive Brokers clients.

Interactive Brokers offering of investments:

| Feature | Interactive Brokers |

|---|---|

| Forex Trading | Yes |

| CFD Trading | Yes |

| Tradeable Symbols (Total) | 7400 |

| Forex Pairs (Total) | 91 |

| US Stock Trading (Non CFD) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy-Trading | No |

| Cryptocurrency (Physical) | Yes |

| Cryptocurrency (CFD) | No |

| Crypto Disclaimer (UK) | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

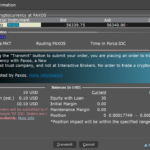

Commissions and fees

Interactive Brokers does appear to offer competitive pricing; however, it is difficult to make a precise comparison as Interactive Brokers does not publish its average spreads for forex. That said, we were able to obtain a sample of one week’s worth of average spread data for the EUR/USD, which ended up coming to a total of 0.6 pips after commission.

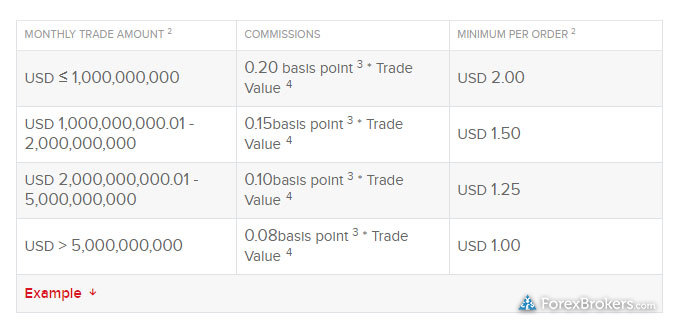

Forex pricing summary: For forex trading, commissions per side start at 0.00002 (0.2 basis points) of the U.S. dollar trade value with a minimum of $2 per order ($4 per round turn), but can drop to 0.08 basis points if you are an exceptionally active trader.

Forex account example: Buying and then selling $100,000 worth of EUR/USD at Interactive Brokers would result in a commission-equivalent of roughly 0.40 pips in addition to any prevailing spreads. Overall, that is a low commission rate for forex trading (note: IBKR Lite and IBKR Pro accounts do support forex trading but are not commission-free).

Minimum charge per trade: Given the minimum commission of $2 per side, trading anything less than 100,000 units of currency becomes proportionally more expensive. The minimum charge by Interactive Brokers for forex is similar to Saxo Bank’s $3 per-order fee charged when trading less than 50,000 units of currency.

Commissions and execution method: For forex traders, Interactive Brokers aggregates prices from 17 of the world’s largest interbank forex dealers. Instead of marking up spreads, Interactive Brokers charges a commission per trade, which ranges from $16 to $40 per million round turn ($8 to $20 per side). This pricing is comparable to brokers that offer commission-based forex trading with agency execution.

Active traders: For active traders, there are discounts that become available when certain monthly trading volume minimums are met. For example, if you trade over $1 billion worth of forex, the minimum charge drops from $2 per order to $1.5, and can go as low as $1 per order when reaching $5 billion per month in volume. Also, Interactive Brokers can handle large order sizes on a Request For Quote (RFQ) basis to minimize market impact and deliver the best possible execution to clients.

Other thoughts: I would like to see Interactive Brokers publish its average forex spreads, especially since it competes so well in other asset classes – like U.S. equities trading (stock trading). Additionally, joining the FX Global Code would further demonstrate its status as a global leader.

Interactive Brokers pricing summary:

| Feature | Interactive Brokers |

| Minimum Deposit | $0 |

| Average Spread EUR/USD – Standard | 0.6 (From 09/25/21 – 10/02/21) |

| All-in Cost EUR/USD – Active | 0.6 (From 09/25/21 – 10/02/21) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | No |

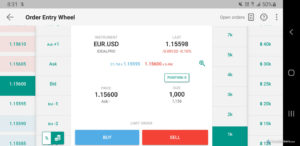

Mobile trading apps

Customizing IBKR Mobile for forex trading can be an involved process, but the app offers a robust trading experience that competes among the industry’s best multi-asset brokers. Interactive Brokers’ recently launched IMPACT app won our award for Innovation.

Apps overview: Interactive Brokers provides its IMPACT app for stocks and crypto, while its primary mobile app for forex and CFD trading is known as IBKR, and is available for iOS on the Apple App Store and for Android devices on Google Play. The app is rich with features, many of which mirror what’s available on the web platform.

One such rich feature is its latest Impact dashboard, where you can assess portfolio metrics in relation to Environmental Social Governance (ESG) factors. There is also an extensive list of predefined watchlists (including two specifically for forex), and an economic calendar that features the ability to add alerts, and can be configured to only show forex-specific economic events.

Charting: The IBKR mobile app features rich charting, and the ability to execute trades from within the charts themselves. There are 127 available indicators, and though there is a lack of drawing tools, I was pleased to find that indicators automatically sync with the TWS desktop platform.

Ease of use: When viewing a given chart, related news headlines display in an adjacent field – a truly helpful feature for comparing the impact of news on market prices. I was pleased to see videos and streaming TV available in the IBKR Mobile app, another feature that mirrors the desktop experience. However, the IBKR app can be generally tricky to use, especially when compared to the best mobile trading apps from category leaders.

Innovation: The IBot tool (also available in TWS) lets you chat with an AI-powered bot (either by typing or via voice command). This thoughtfully-developed tool can recognize and act upon commands such as, “Show me a chart of the EUR/USD.” In this example, IBot would return a relevant chart that can be opened directly from the search results.

nteractive Brokers mobile trading:

| Feature | Interactive Brokers |

| Android App | Yes |

| Yes | |

| Alerts – Basic Fields | Yes |

| Watch List | Yes |

| Watch List Syncing | Yes |

| Charting – Indicators / Studies | 98 |

| Charting – Draw Trendlines | No |

| Charting – Trendlines Moveable | No |

| Charting – Multiple Time Frames | Yes |

| Charting – Drawings Autosave | No |

| Forex Calendar | Yes |

Other trading platforms

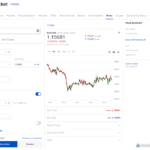

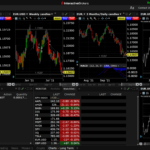

Interactive Brokers stands out for its trading platforms, which include its flagship desktop software and web trading app – both of which provide access to advanced trading tools and global financial markets (including forex and CFDs). Interactive Brokers’ web-based platform is geared towards everyday retail traders, whereas the desktop platform is complex, and challenging to use and customize – even for professionals.

Platforms overview: Trader Workstation (TWS), Interactive Brokers’ flagship desktop trading platform, can be best described as knotty. It’s packed full of features that cover the whole spectrum of trading products, but its complexity may make it less accessible to beginner traders.

Interactive Brokers’ Client Portal is a web-based trading platform that has a good balance of features, such as forex news headlines and related economic calendar events, trading, and even syncing watch lists. This platform is far more approachable for casual investors, and I found it enjoyable to use in my own testing.

FXTrader is the main terminal within TWS for trading forex, and provides access to 91 forex CFDs or 105 cash forex pairs offered by Interactive Brokers. When adding forex pairs to a watch list, users can choose from both spot forex cash rates and forex CFDs from either the IDEALPRO or SMART venue.

Charting: TWS charts offer 127 available studies, which is far above the industry average but less than, say, thinkorswim by TD Ameritrade – which offers over 300. That being said, there’s no question; TWS offers a powerful charting experience. Likewise, the Interactive Brokers’ Client Portal has charts powered by TradingView where you can select from 98 indicators and add as many as 8 at a time.

Ease of use: While the number of customizations available in the TWS desktop platform is impressive, the inherent complexity and the long lists of possible configurations can be intimidating for unseasoned investors. For example, the watchlist alone can be configured with over 650 different available columns. Saxo Bank, CMC Markets, and IG all also offer robust trading platforms, but they are more streamlined and far easier to use.

Advanced orders: Interactive Brokers’ TWS platform supports complex orders such as its Basket order (much like TD Ameritrade’s Blast order or the Custom Basket order offered by XTB) along with One Cancels All orders and many others. This deep level of complexity can be an advantage for traders who are looking to use advanced strategies.

Interactive Brokers trading platform:

| Feature | Interactive Brokers |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy-Trading | No |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| cTrader | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 127 |

| Charting – Drawing Tools (Total) | 9 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 651 |

| Order Type – Market | Yes |

Market research

Out of all brokers reviewed on ForexBrokers.com, Interactive Brokers still offers the widest array of third-party research for 2022.

IBKR offers 220 services from 86 news and research providers (some of which require a paid monthly subscription) and 21 directly cover forex news and research. Interactive Brokers has an overall excellent research offering, but I’d like to see an expansion of its forex-specific content.

Research overview: Interactive Brokers’ research content will satisfy the vast majority of traders – but you have to know how to find it. Much of the third-party research is available in Trader Workstation (TWS) and on the Client Portal. Content from in-house and guest authors featuring articles published throughout the trading week can be found on the Traders’ Insight blog. Interactive Brokers also streams market headlines and news from sources like Reuters, Dow Jones, and Market News International (MNI), and its economic calendar is powered by providers like Econoday. Finally, institutional investors gain access to UBS Live Desk market analysis.

Market news and analysis: Interactive Brokers provides forex research that is produced in-house, as well as from dozens of third-party providers, including free and premium (paid) subscriptions. There is also a growing selection of forex-specific articles and related written content on the Traders Insights blog.

Video content includes Bloomberg Television (U.S. and Asia), daily market updates from IBKR Traders’ Insight, and The Fly Squawkbox Live podcast. Though forex is not its main focus, the Traders’ Insight daily video update is produced by IBKR’s Chief Strategist, which I found to be a great quality.

Interactive Brokers research:

| Feature | Interactive Brokers |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Delkos Research | No |

| Social Sentiment – Currency Pairs | Yes |

| Economic Calendar | Yes |

Education

Interactive Brokers’ wide variety of quality educational content (including a growing selection of forex-specific content) ranks way above the industry average, putting it just shy of becoming an industry leader for education. However, the primary focus of Interactive Brokers’ educational offering is the stock market (share trading) – not forex or CFDs.

Learning center: Interactive Brokers offers several dedicated resources for education, including its Traders’ Academy portal, IBKR Quant blog, and IBKR Campus. Created by in-house staff and third-party educators, I found the content to be plentiful, diverse, and of high quality.

The Traders’ Academy portal effectively covers broader financial market sectors, with lessons and accompanying videos that are organized by experience level. There is also a small but growing selection of forex courses (two newly added in 2021) which include quizzes and progress tracking, as well as a Coursera course that Interactive Brokers has developed with a University-style syllabus.

Room for improvement: Given the complexity of its TWS platform, I was not surprised to find that most of the broker’s educational videos were platform tutorials. On Interactive Brokers’ Youtube channel, I found very few videos about forex and CFDs, despite a large variety of content related to other asset classes. It’s worth noting that Interactive Brokers has slowly and steadily expanded its forex content, and I noticed a year-over-year improvement in this category.

Interactive Brokers education:

| Feature | Interactive Brokers |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Interactive Brokers’ proprietary Trader Workstation platform, combined with competitive commissions and its diverse global product offering make it an excellent choice for professional traders and seasoned traders.

For institutional clients, IBKR is No. 1 in my book and won our award for Innovation. In 2022, Interactive Brokers finished Best in Class for its Offering of Investments, Research, Commissions & Fees and Professional trading.

However, low-volume or beginner forex and CFD traders should take note; miscellaneous fees – such as market data subscriptions – as well as the complexity of its proprietary platforms should be taken into consideration when deciding whether Interactive Brokers will be a good fit for your trading style.

Does IBKR charge for currency exchange?

When it comes to forex trading, Interactive Brokers passes the prices that it aggregates from interbank liquidity providers (LPs) directly to its clients with no markup to the low underlying spreads, simply adding a per-trade commission. Likewise, for its currency conversion – which allows you to convert your account balance from one currency to another – the same process applies. You are shown the underlying forex rates, and a small commission is charged when you convert your balance.

How do you do FX on Interactive Brokers?

Interactive Brokers caters to forex traders through its desktop, web, and mobile trading apps. There is an entire section on the Trader Workstation (TWS) desktop dedicated to FX Trading, where you can prepare and place orders for IBKR to execute. Likewise, the web and mobile app enable you to trade forex, and are much easier to use than the TWS desktop version. That being said, many of the advanced features available on TWS for forex trading are not available on the web and mobile apps.

Can you trade forex on IBKR?

Forex trading is available globally to IBKR clients – except in the U.S., where it is only available to institutional clients. In other words, if you are a retail or professional client in the U.S., you cannot trade forex with IBKR, unless you meet the definition of an Eligible Contract Participant (ECP) with at least $10 million in assets.

About Interactive Brokers

Founded in 1977, Interactive Brokers is one of the oldest online brokerages in the U.S. and has been listed publicly (NASDAQ: IBKR) since 2007. Interactive Brokers has 1.73 million clients and is well-capitalized with $7.1 billion in excess regulatory capital and USD 373.8 billion in client equity.

Interactive Brokers was one of the first brokers to offer a multi-asset solution that now includes equities, options, forex, futures, and bonds across 135 market centers in 33 countries, and 23 currencies, and from a single trading account.

While retail forex is not available to U.S. residents at Interactive Brokers, Eligible Contract Participants (ECPs) with at least $10 million in assets are still eligible.