Overall summary

| Feature | XTB |

| Overall | 4.5 Stars |

| Trust Score | 95 |

| Offering of Investments | 4.5 Stars |

| Commissions & Fees | 4.5 Stars |

| Platforms & Tools | 4 Stars |

| Research | 4.5 Stars |

| Mobile Trading Apps | 4.5 Stars |

| Education | 4 Stars |

Is XTB safe?

XTB is considered low-risk, with an overall Trust Score of 95 out of 99. XTB is a publicly traded company that is authorised by one tier-1 regulator (high trust), three tier-2 regulator (average trust), and one tier-3 regulator (low trust). XTB is authorised by the following tier-1 regulator: Financial Conduct Authority (FCA).

Regulations Comparison

| Feature | XTB |

| Year Founded | 2002 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 3 |

| Tier-3 Licenses | 1 |

| Trust Score | 95 |

Offering of investments

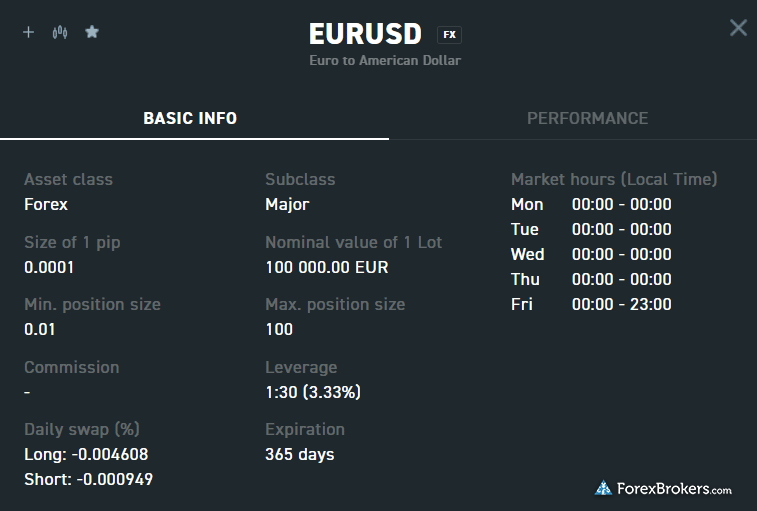

XTB provides traders access to CFDs on 1,848 stocks, 135 ETFs, 22 commodities, 36 indices, 5 cryptocurrencies, and 57 forex pairs. XTB also provides nearly 7,800 cash equities (non-leveraged)and 150 ETFs as part of its securities offering (though these are not available from its U.K. or Cyprus branches). The following table summarizes the different investment products available to XTB clients.

Cryptocurrency: Cryptocurrency trading is available at XTB through CFDs and through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except for professional clients).

XTB offering of investments:

| Feature | XTB |

|---|---|

| Forex Trading | Yes |

| CFD Trading | Yes |

| Tradeable Symbols | 10000 |

| Forex Pairs | 49 |

| US Stock Trading | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy-Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Crypto Disclaimer (UK) | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

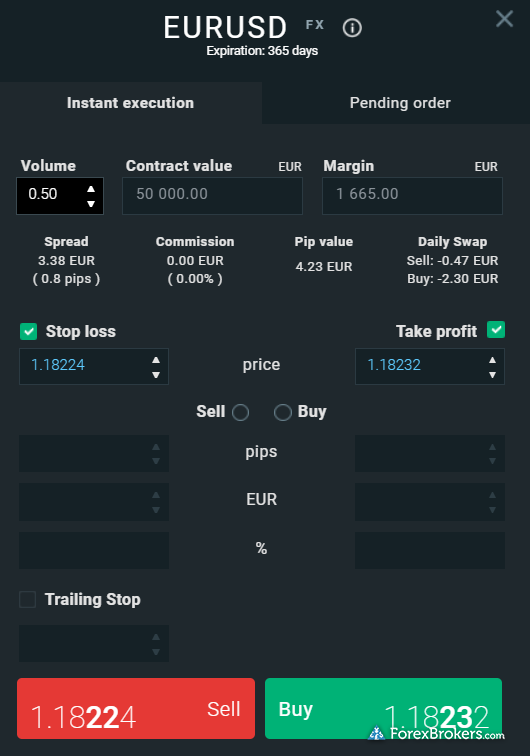

XTB offers two account types; there’s a spread-only Standard account, and a commission-based Professional account – though this option is reserved for clients who meet the definition of elected Professionals in the U.K. and Europe. Overall, pricing at XTB is in line with the industry average but trails the best brokers in this category.

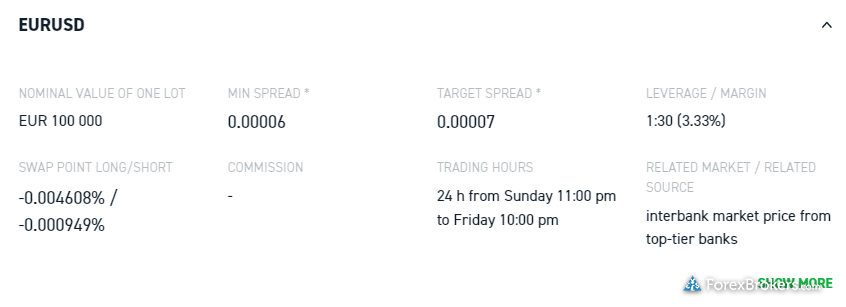

Average spreads: Using data from Q3 2021, XTB average spreads on the EUR/USD stood at 0.91 (note: the commission-based pro account is being phased out and is no longer promoted).

Standard vs. Pro accounts: XTB’s Standard and Professional accounts have similar pricing when trading at higher volumes – and minimum deposits start at 250 base currency (£250, €250, or $250). For smaller amounts, however, the Standard account appears to be cheaper. My choice for retail traders would be the Standard account, especially as the Pro account is no longer available in most regions – except for certain legacy clients.

Active trader discounts: For active traders (and those in the EU who meet the definition of elective professionals), XTB will rebate a portion of the spread (from 5% to 30%) back to you when you reach certain volume thresholds, starting from 20 lots per month to as much as 1000 lots for the full 30% discount.

XTB pricing summary:

| Feature | XTB |

| Minimum Deposit | $0.00 |

| Average Spread EUR/USD – Standard | 0.9 (Q3 2021) |

| All-in Cost EUR/USD – Active | 0.9 (Q3 2021) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile trading apps

While the MetaTrader 4 mobile app is available in certain locations, XTB’s proprietary xStation 5 mobile app is far superior and available everywhere. There’s no question; XTB’s mobile app can compete with the best forex brokers.

xStation mobile features: The xStation 5 app is cleanly designed with several features that mirror its web counterpart, such as streaming news, predefined watchlists, an economic calendar, top movers, and client sentiment data. Several integrated videos in the mobile app also provide webinar-style educational content, with multiple videos that are over an hour long.

xStation charting: xStation 5 charts are good, but not great; I was disappointed to find that watchlists do not sync with the web version of the platform, and that there are only half as many indicators (13 total). Nice features in xStation 5 mobile charts include an automatic-save feature for your trend lines and drawings, and the ability to easily add indicators to your charts while zooming in on various time frames.

XTB mobile trading:

| Feature | XTB |

| Android App | Yes |

| Apple iOS App | Yes |

| Alerts – Basic Fields | Yes |

| Watch List | Yes |

| Watch List Syncing | No |

| Charting – Indicators / Studies | 30 |

| Charting – Draw Trendlines | Yes |

| Charting – Trendlines Moveable | Yes |

| Charting – Multiple Time Frames | Yes |

| Charting – Drawings Autosave | Yes |

| Forex Calendar | Yes |

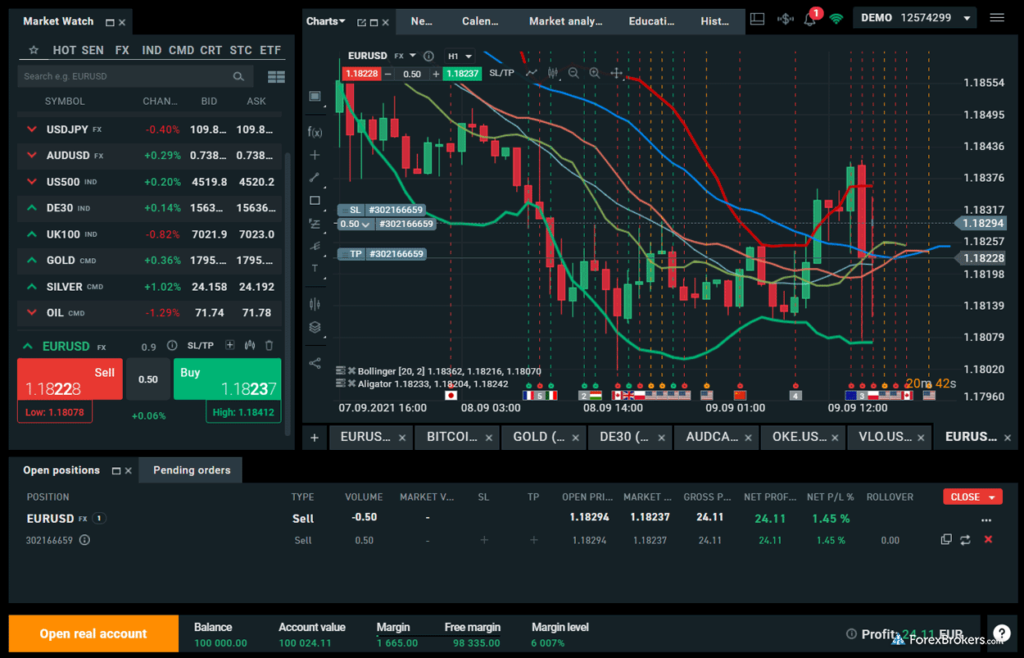

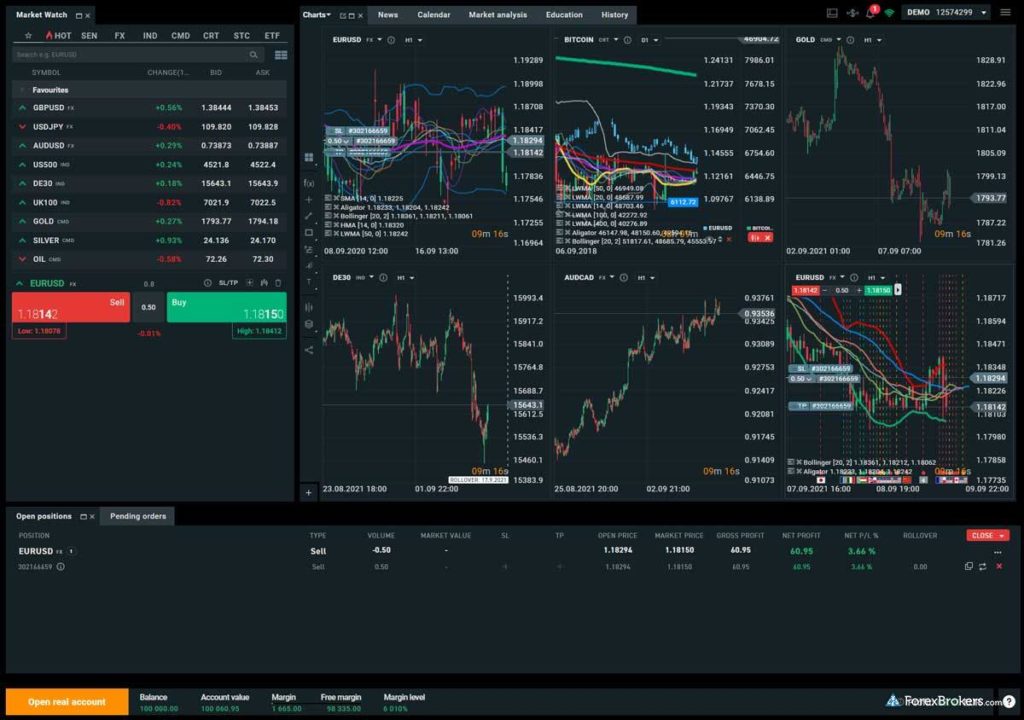

Other trading platforms

XTB offers MT4 in select locations, but its feature-rich xStation 5 platform steals the show with its minimalist design and powerful tools.

Platforms overview: XTB offers two flagship web-based trading platforms: xStation 5, and – from select locations – the MetaTrader 4 (MT4) platform developed by MetaQuotes Software Corp (not available from Cyprus, France, or the U.K.).

Charting: Beyond its responsive modern design (and its 30 drawing tools and 39 technical indicators), there are several unique features that help xStation 5 stand out. For example, I loved the fact that charts include a countdown timer showing the remaining time left in each candlestick. Also, economic news releases appear along the bottom axis of its charts, providing traders with helpful insights during important economic events.

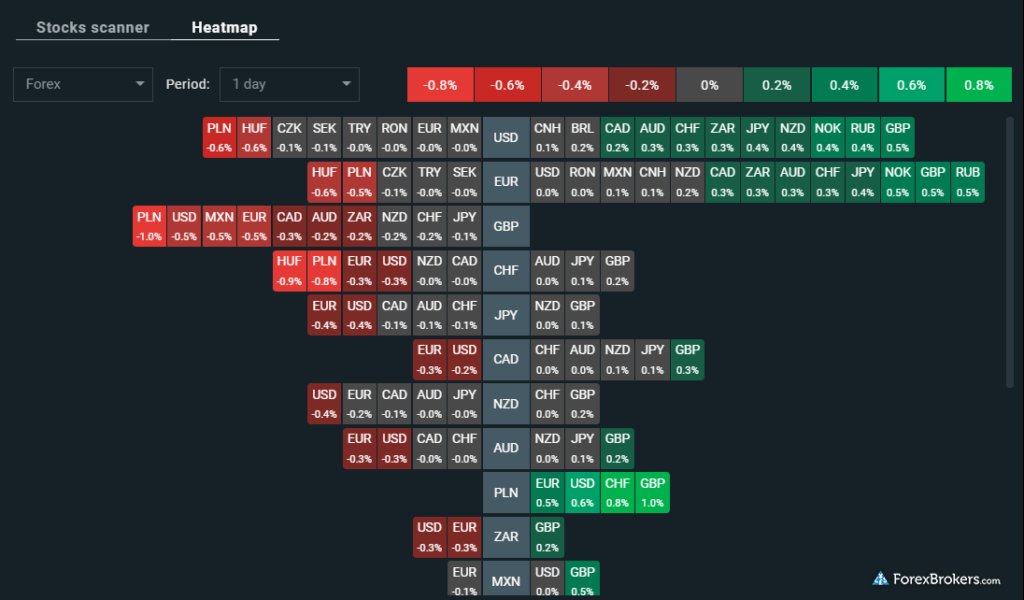

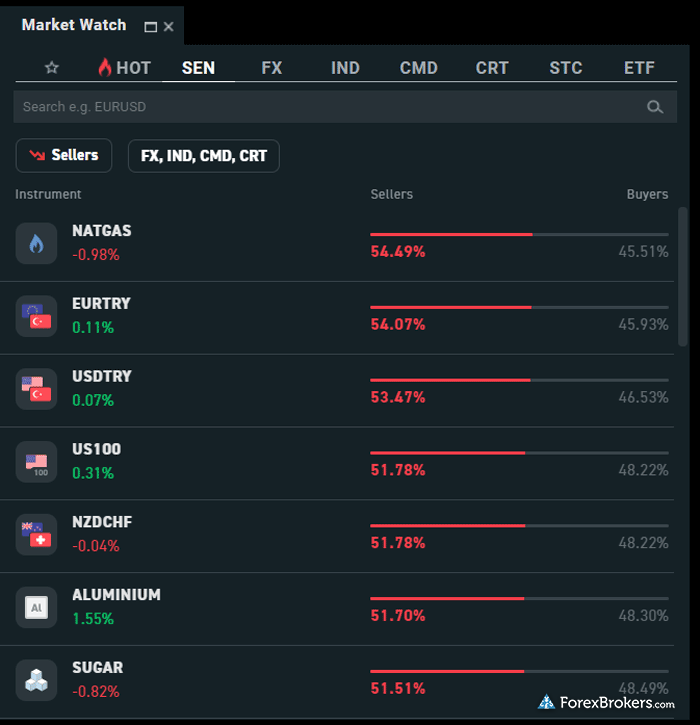

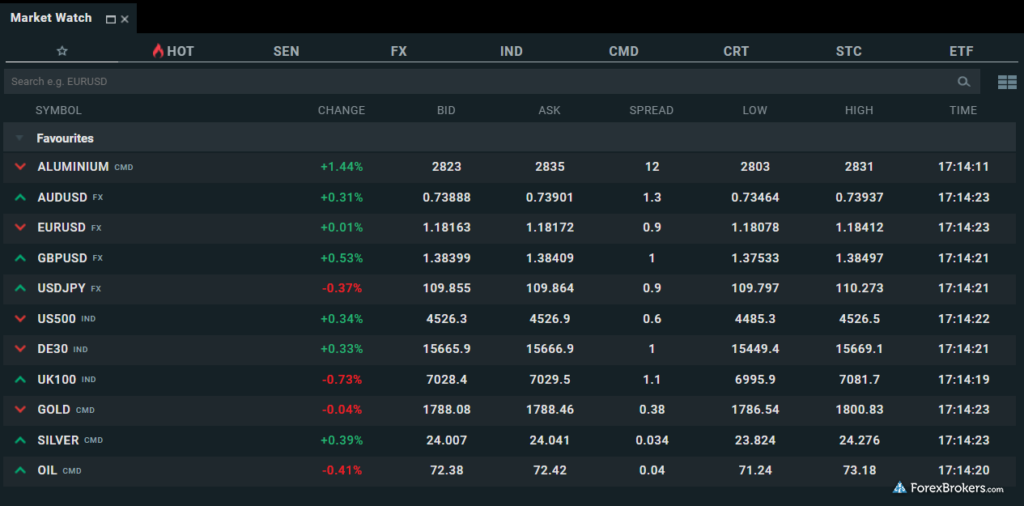

xStation 5 trading tools: XTB’s flagship platform offering, xStation 5, delivers an excellent experience for web, mobile, tablet, and even iOS and Android smartwatches. Trading tool highlights include color-coded heat mapping for analyzing top movers, a versatile stock screener, and sentiment data that shows the percentage of XTB clients that are long or short for a given trading symbol.

XTB trading platform:

| Feature | XTB |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy-Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| cTrader | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 51 |

| Charting – Drawing Tools (Total) | 31 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 7 |

| Order Type – Market | Yes |

Market research

XTB’s research content can compete with the best in the industry, thanks to high-quality analysis from in-house staff as well as third-party providers. That said, XTB does not publish as many daily English articles and videos as some of the best brokers in this category – though it does have a strong international presence in other languages.

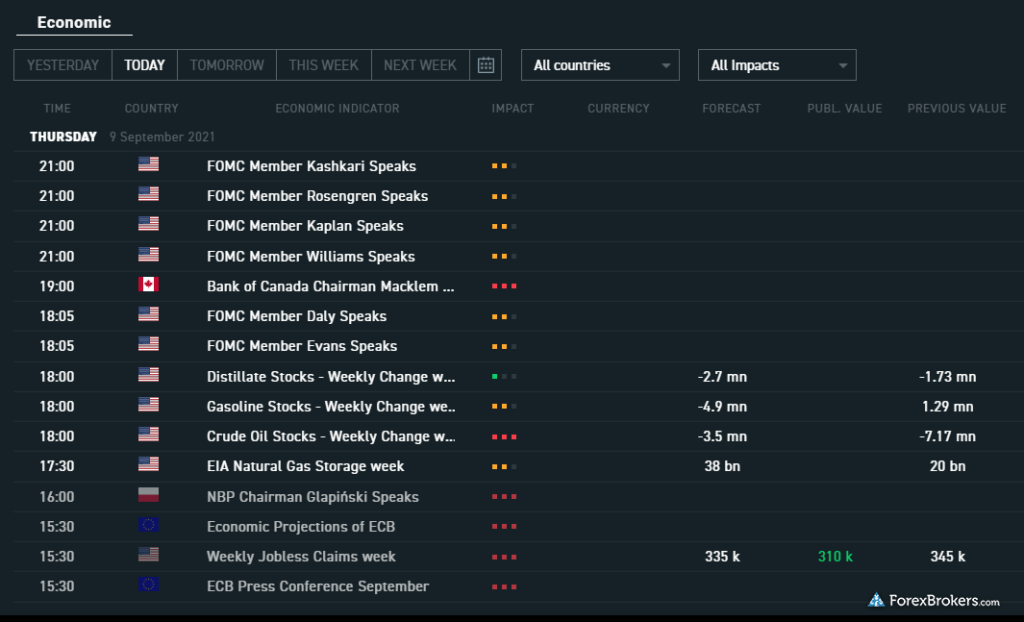

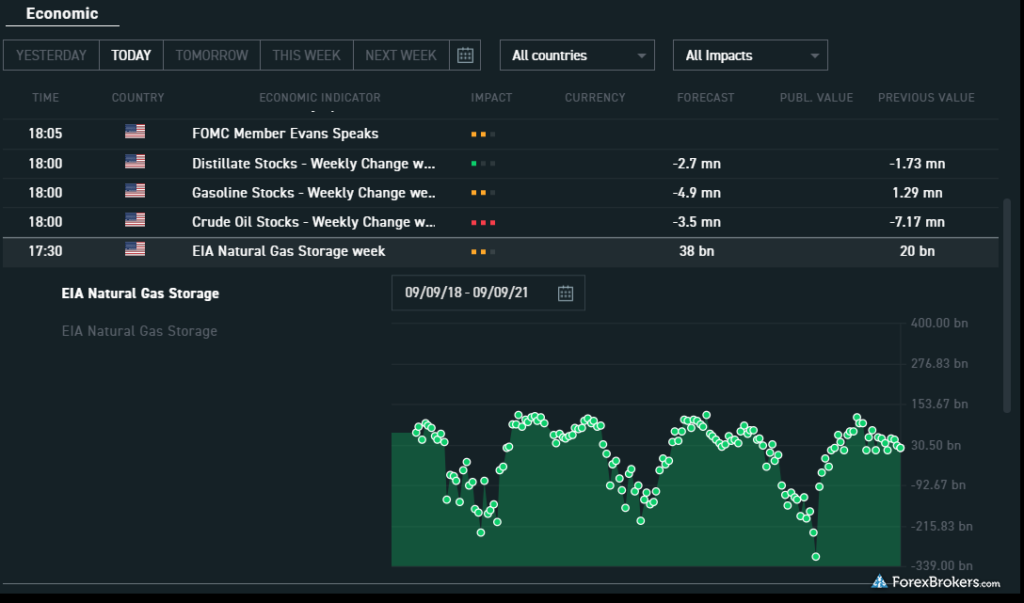

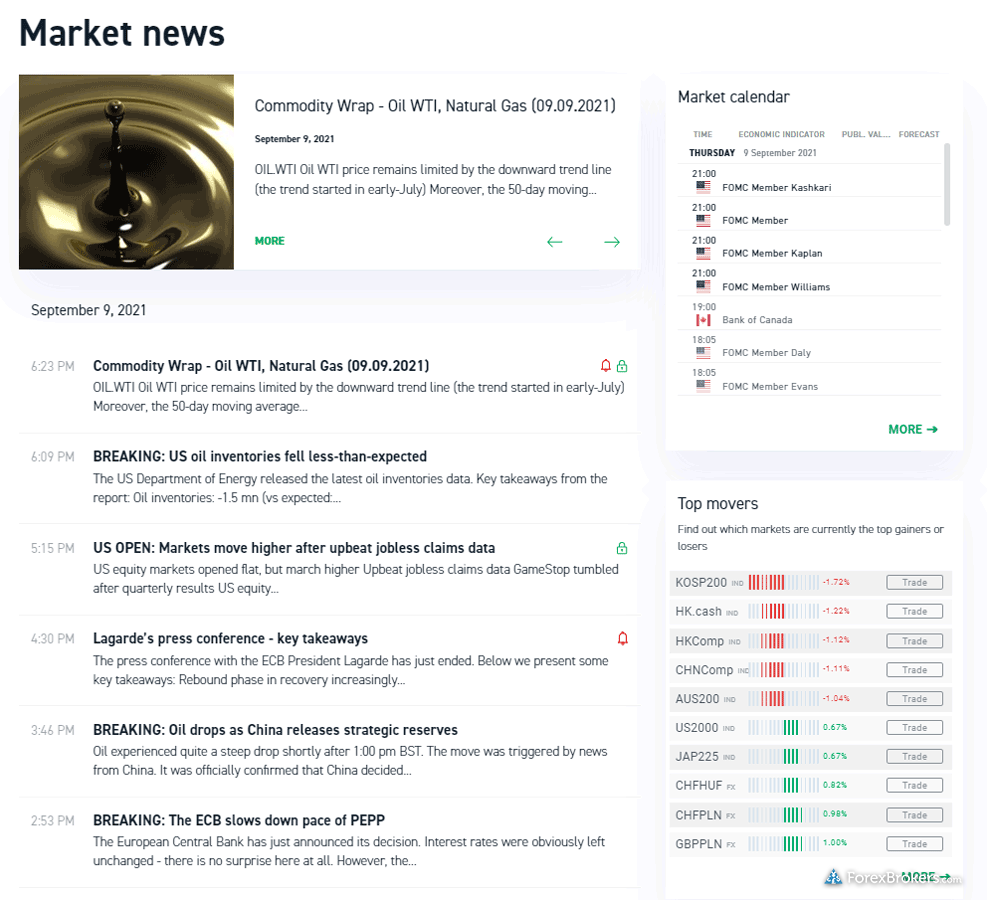

Research overview: XTB makes up for the absence of Trading Central and Authochartist by offering exclusive strategies as part of its Premium Research service. In addition to streaming headlines from top-tier news providers, XTB offers an economic calendar, market sentiment, and other platform tools for research. XTB also provides written articles from its staff and weekly video webinars on YouTube, including in other supported languages, such as Polish, German and Italian.

Market news and analysis: XTB publishes quality articles on its Market News section which are then streamed as headlines within the xStation 5 platform. The research includes both fundamental and technical analysis, with features such as its “Chart of the day” series. Trading signals are also included within XTB’s news panel, with price analyses from Thomson Reuters, Barclays, Citi Group, and other top-tier providers.

News filtering: Identifying articles written by in-house staff (versus third-party content) is not a seamless experience at XTB. Saxo Bank’s web platform, for example, allows for the ability to filter news content by source (in-house vs third-party). As a trader, I appreciate what XTB’s staff has to say, so the ability to filter or easily identify in-house content would be a welcome enhancement.

XTB research:

| Feature | XTB |

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Delkos Research | No |

| Social Sentiment – Currency Pairs | Yes |

| Economic Calendar | Yes |

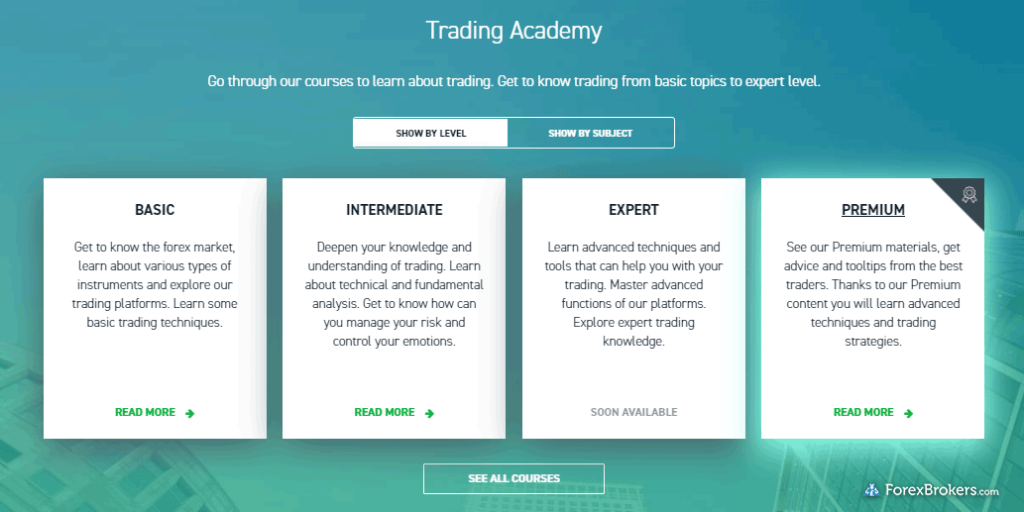

Education

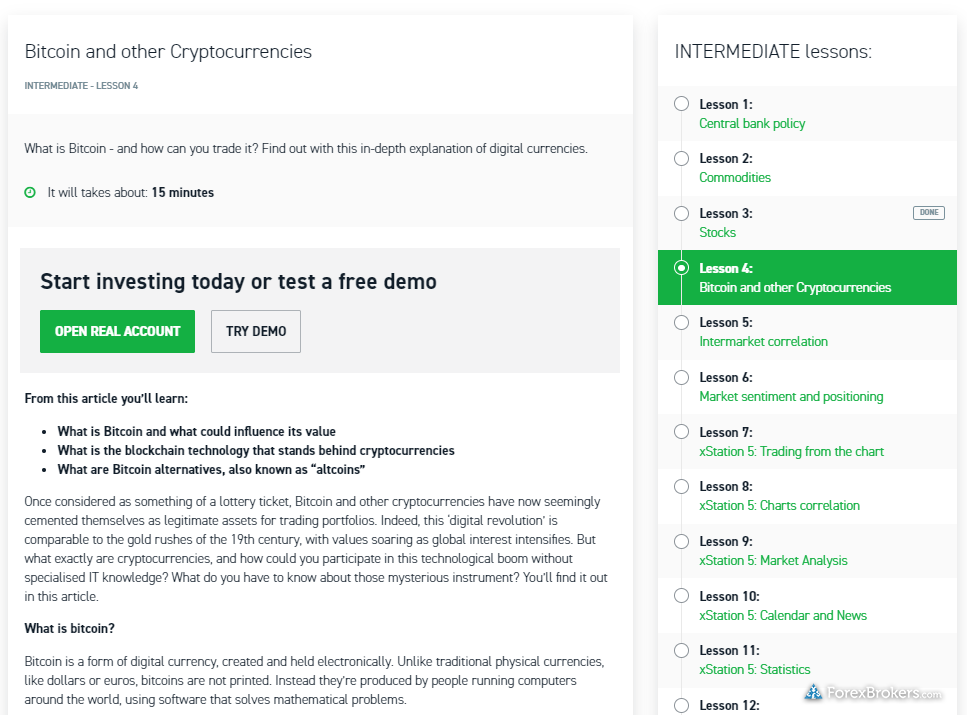

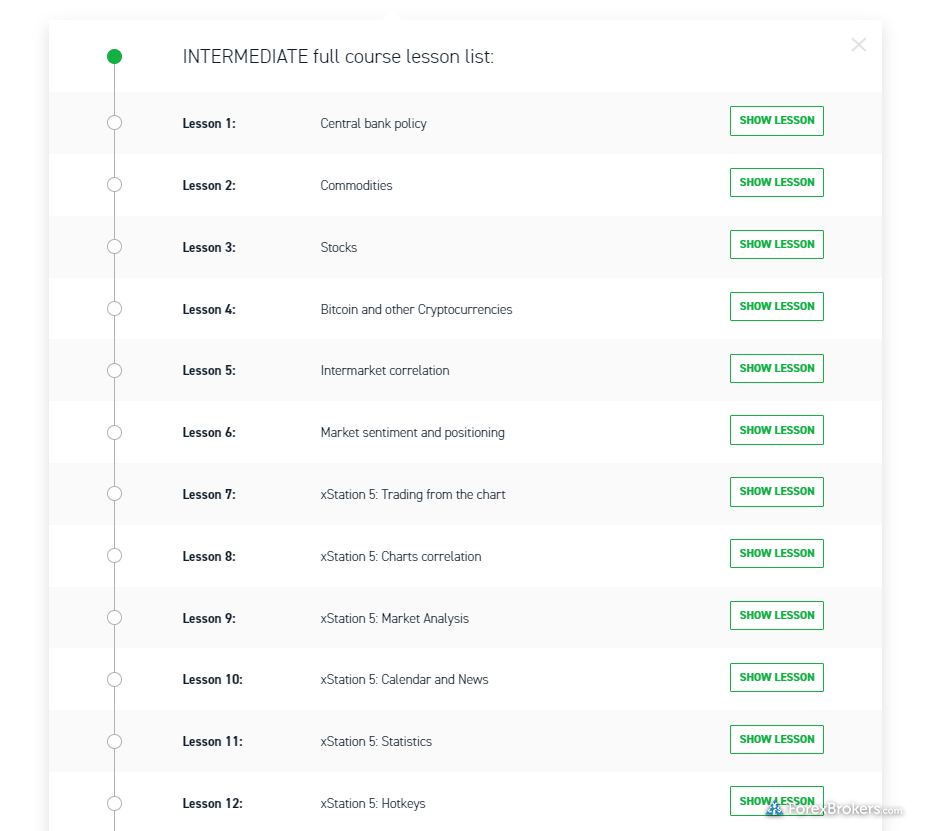

I was impressed with XTB’s educational offering, thanks to its extensive written content, video materials, and archived webinars. XTB generally does a great job incorporating education throughout its platform suite and website. The only drawback is the lack of organization of its video content– it doesn’t all live in one place, and is instead scattered throughout its platform and its YouTube channel.

Learning center: XTB provides a variety of materials on its website under the “Learn To Trade” section, all of which can be sorted by topic or experience level. There are more than 200 lessons available in XTB’s well-organized Trading Academy, along with enhanced FAQs, platform tutorials, financial market education, premium content for live account holders.

There are at least ten lessons that cover forex and CFD education, and each category features quizzes. There are also dozens of articles covering broader subjects like “What are macroeconomic indicators?”

Room for improvement: XTB provides a good balance of videos within its Trading Academy and on its YouTube channel, including 17 videos in its Masterclass series. Many of these videos are also integrated in the Premium section within the xStation 5 web platform and mobile app. Organizing all these videos by category or experience level, and keeping them in one place – such as within the Trading Academy or a dedicated video library – would be a great way to arrange for seamless access to all of XTB’s video content. In addition, I liked that progress tracking is incorporated, giving traders the option to measure their learning progress – though quizzes or tests would be a welcome addition.

XTB education:

| Feature | XTB |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | No |